CHAPTER 1 OF BOOK

CHAPTER 1 OF BOOK “HOW I WOULD RUN THE COUNTRY IF I WERE DICTATOR” by Argus C. Zall

Chapter 1: The Federal Budget Deficit

In this chapter I decree a number of steps to eliminate the budget deficit as a necessary first step befor I can tackle any of the other problems we face.

CHAPTER I

Of Book

THE FEDERAL BUDGET DEFICIT

(Copyright July 31 2006)

You may be surprised that I have chosen the Federal Budget Deficit as the problem to attack first. The reason is that our international problems are made much more difficult to deal with because of it. As we shall see, foreigners own a large fraction of the bonds that comprise the National Debt. Since the prescriptions I will propose in other areas will have a strong negative impact on these creditors, their natural reaction will be to a) stop buying newly-issued bonds; and b) dump at least some of the bonds they already hold. At the very least, this will result in a significant increase in the interest rates required to float new bond issues, interest rates that will percolate throughout the economy, exacerbating the pain that the reform prescriptions will impose.. To coin a new “old saying”, “It is most unwise to fart in your banker’s face.”

The first step is to get our own house in order.

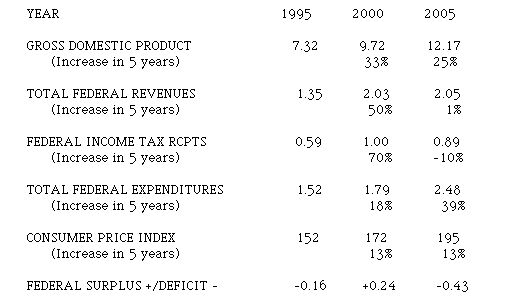

Let’s start with some simple numbers. (in TRILLIONS OF DOLLARS)

(Statistical Abstract of the US US Census Bureau (Hereinafter abbreviated “SATUS”) (2006) Table 459 (GDP determined by dividing outlays by stated percent of GDP)

and SATUS (2006 Table 706 (CPI determined from 2004, last year given, by adding 3%)

Two problems are glaringly obvious. First, because of the Bush tax cuts, Federal revenues did not grow at all between 2000 and 2005, although the GDP increased by 25%. Second, Federal Expenditures

grew 56% faster than the GDP. If the expenditures had increased only as fast as the GDP, they would have been 2.24 trillion in 2005, reducing the deficit by 0.24 trillion.

The Bush tax cuts were supposed to be paid for by allowing the economy to grow faster. However, the economy grew 25% between 2000 and 2005, slower than it had grown between 1995 and 2000, under the higher tax regime prevailing then. One must conclude that the fundamental assumption on which the tax cuts were predicated was wrong. They did not cause the economy to grow fast enough to pay for themselves.

I will start with the fact that there is believed to be $345 billion in income tax that goes uncollected each year. (Stephen J. Dubner and Steven D. Leavitt “Tax Honesty comes not from altruism but fear” Boston Sunday Globe, Business and Money Section pp F1 and F6, April 2 2006) Much of this is in the category referred to as “non-farm- proprietor’s income”, ie a category in which income is reported only by the recipient, (such as small business owners with heavy cash components to their receipts) with no independent corroboration. Addition of just one-half of this amount, $0.17 trillion, to the present income tax receipts would bring total federal revenues to $2.22 trillion, and reduce the deficit to $0.26 trillion

I would politely suggest to all those who have underreported income that they would find it advisable to file amended returns for the previous three years reporting the correct amount; I will waive interest and penalty charges and any criminal charges that might otherwise be imposed. They should note that within a few years, I will be instituting a cashless electronic system of settling all accounts. (See Chapter 9) Under court order, tracers can be put on any account to determine all transactions into and out of it, so that the net income can be verified. Serious discrepancies between actual and reported values for receipts, expenditures, and net income will result in serious jail time. It will be much to every taxpayer’s advantage to correct any prior discrepancies now, and to walk the straight and narrow path in the future, before this day of reckoning arrives.

If the corrected returns failed to provide the necessary income, I would not hesitate to mandate a surcharge on all taxes. The next step will be to require a 10% cut in total expenditures. This will bring expenditures to 2.24 trillion, and revenue to 2.40 trillion; the 0.16 trillion surplus will go into an emergency fund, to cover such things as natural disasters or other emergencies. In future years, the surplus will go towards a) replenishing the emergency fund, and b) debt retirement.

This will be only a temporary expedient, however, to buy some time to make real reforms in how the Federal government budgets and spends. The problems are systemic, and can only be rectified by a complete change in the way it does business.

One of the problems is that the Federal Government makes absolutely no distinction between capital outlays and current expenses. If you tried to run your corner grocery store the same way the Federal Government runs, the IRS would have you in jail for improperly charging against this year’s income the expense of a new freezer cabinet that it claims will last ten years. You have to capitalize it and charge off only one tenth of the expense against any one year’s income. The town where I live routinely issues revenue bonds to pay the cost of a new school over ten years instead of charging it in one lump sum the year it is built. The cost of amortizing those bonds is then added into the operating budget of the department for which the expenditure is made. That is the fundamental purpose of going into debt; to pay for a capital asset over the time it is going to be used.

On the other hand, if the Feds build a new office building (read “Taj Mahal”) for those hard working servants of the people, the US Congress, construction costs are charged in full the year they are incurred, even though with a little bit of luck, the thing will outlast the incumbencies of most of its occupants.

So the next edict I would issue as Dictator is that all budgets must be separated into capital and operating expenses, and I would have an absolute balanced budget. Operating expenses plus the cost of amortization of revenue bonds for prior capital expenditures, must be met in full by tax revenues in the year they are incurred. Then it is possible to look in a rational way at the capital expenses and prioritize them the way any business or family would do. How much can we afford in the way of “mortgage payments” on revenue bonds. That will dictate how much we can afford to borrow for needed capital additions and improvements.

Next, I would require that Congress debate no other matter on the floor or in committee from the beginning of its session until the operating budget was appropriated, the capital budget was appropriated, the debt retirement budget was appropriated, and the necessary taxes to pay for these were levied. Then and only then could it debate all those stirring issues that attract so much attention on the national TV news: investigations of executive malfeasance, legislation against every conceivable peccadillo except picking one’s nose in public. To ease the burden on the legislators, they would only have to do the budgeting once for each two-year session of Congress; the budget would be a two-year budget. That way, they will be able to spend the last three quarters of the second year running for re-election (as they do now anyway) without leaving the finances of the Republic dangling in air. The least harmful thing the Congress does is run for re-election. As long as they do the job of providing the funds to meet the budget, the country is far better off if they spend all their time running for re-election.

And, by the way, I would abolish the two-step “authorization” followed by “appropriation” process now in use. Today, one set of committees works out the “authorization” of the budget and its expenditures, and a totally different set of committees “appropriates” the funds, paying only nominal attention to the work of the authorizing committees. With my new system, once the budget is authorized, the funds will automatically considered to have been appropriated. The House of Representatives will have the sole responsibility for developing, authorizing, and appropriating the budget. The Senate will have only line item veto power. Since senators can threaten to veto some representative’s cherished pork, they will still have leverage to get their pork-barrel items included in the House’s budget.

Having developed and appropriated the operating budget and its expenditures, the Congress must then levy the taxes to pay for them in the same fiscal year. There can be no greater fiscal discipline imposed upon a spendthrift politician seeking re-election than the realization that he will have to go before his constituents and explain why their taxes increased during his tenure in office.

With operating budget settled, the attention of Congress could turn to the capital budget, determining the investment of the government in new capital infrastructure, issuing the bonds to pay for it and levying taxes to cover the amortization costs thereof.

Then, I would absolutely prohibit the Congress from attaching any amendments to any legislation that was not fully germane to the purposes of that legislation; such amendments would be ruled “out of order” by the Parliamentarian (as indeed they are in my Town Meeting assembly, and should be today in the Congress). Any such legislation desired would have to be introduced in “stand-alone” form, to be debated and voted on by the full Congress in full view of the public. That, together with the elimination of “earmarks” attached to the budgets of the several departments would essentially break the power of the lobbyists who gather around the Capitol like flies around a pile of horse manure.

In addition, voice votes or show-of-hand votes will be abolished. All votes must be recorded, and I would require every Congressman and Senator to swear under penalties of perjury that he had read and understood every word in the bill or amendment he was voting on, as part of the voting process. No more hiding behind the skirts of committees, or of non-elected congressional staff. Everything in Congress must be public, and every member will be held accountable. for his votes, or the absence thereof.

And finally, I would retain for myself as Dictator a line-item veto to use to eliminate the vast majority of “pork-barrel” items and earmarks.

You may ask why I would even allow Congress to exist; after all, I have said I would be a dictator. But there still need to be some checks and balances in the system. My intent is to prevent single–issue, special-interest minorities from blocking all progress and reform. So I will have to reform Congress as well. First, I will abolish all political parties. Second, I will decree that all cash raised by any candidate for election or on his/her behalf must be raised within the electoral district or state. No outside money will be allowed to influence the election. The job of Representatives and Senators is to represent the interests of their districts and states to the nation, and the interests of the nation to their districts and states, not the interests bought and paid for by cash-rich litmus-test super-minority groups.

Then, I will redistrict the entire country by computer, subject to the constraints that all districts must be equal in population within ten percent, and that the ratio of district perimeter to the square root of district area can be no greater than 5. (The values of this ratio for a circle, square, 2:1 rectangle, and equilateral right triangle are 3.54, 4.0, 4.24, and 4.82, respectively.) No consideration of ethnicity or race of the populations within the district are allowed. Provided the above conditions are met, district boundaries may conform to municipal or county boundaries.

Since there will be no parties, there will be no primary elections. All candidates will run in the general election. If no candidate achieves a majority, the top candidates whose votes in the general election totaled more than 50% will face a run-off election two weeks after the general election, If no majority in the runoff election is achieved, runoff elections will be repeated at two-week intervals until one candidate receives a majority vote.

Congress shall have the right to veto by a two/thirds majority in both houses (of the total membership, not merely those present and voting) any of the programs I dictate. I will then call for a general election to override the veto, to be held within two weeks. Registered voters will receive in one envelope a document from me giving the arguments in favor of my reform plus a document from their representative and senator explaining the reasons why he/she vetoed it or supported it. No other information or argument pro or con will be allowed before the election. Since there would have been ample public debate before the Congressional-veto vote, there is no need for any strident posturing before the override election. Voters wishing to vote on the matter will be required to show at the polls that they have received the informational materials and demonstrate that they have understood it by reciting from memory at least one argument pro and con, before they will be allowed to vote. A two-thirds majority of the national vote will be required to sustain the veto; otherwise it is overridden. Any member of Congress whose district or state fails by simple majority vote to ratify his vote in Congress will be deemed to be unrepresentative of his/her district and will be removed from office. A replacement will be elected in a general election two weeks later (in which the removed member of Congress is free to run).

Thus, Congress and the people will have the right to overrule a dictatorial ukase that is vehemently opposed by a majority of the country. My dictatorial powers will be limited merely to prevent noisy minorities from buying opposition to correcting the ills that beset our nation.

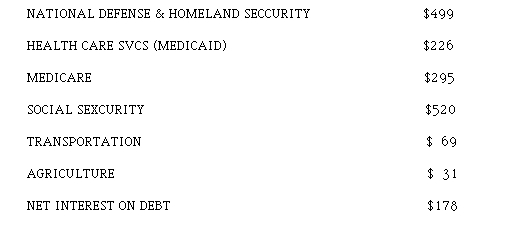

So, how am I going to cut expenditures by 10% without leaving the Nation defenseless, or turning old people out into the street? Watch, and I will show you. First of all, let’s look at where the majority of the money goes. (SATUS 2006, Table 463) It turns out that 75% of the expenditures are in just a few major categories. See below (billions)

If we are going to cut expenditures, by $240B, these are going to have to be cut to the tune of $180 billion, because in the deathless words of Willie Sutton, when asked why he robbed banks, “That’s where the money is!”

Like I said, it’s really going to take a dictator to do this job, because I can hear the screams already. “Social Security is Sacred”; “you can’t cut Health and Human services, it’s already bare bones”; “the country will be naked before its enemies” etc., etc., etc.

I will postpone the discussion of the Defense and Homeland Security budgets until a future chapter, because I have some major changes to make in the operation of these departments.

Social Security I would cut by admitting what everybody knows already. It is not an actuarial retirement system, but a transfer system taxing working people to pay income to people who have retired, whether they need it or not. Therefore, I would institute a means test for social security. We presently do not make social security payments to otherwise-eligible people who earn wages or salaries or other personal-service income, on the very rational grounds that “they don’t need it”. At the same time we do pay people with very comfortable pensions from their former employers, as well as millionaires with investment income so big they can’t spend it all.

There are 31 million persons in the US aged sixty-five or older who are collecting social security retirement pay (SATUS 2006, Table 530); 11 million of these also have other pensions, 19 million collect property income (interest, dividends, rent, royalty, estate, trust fund). The wealthiest of these receive higher social security payments than average, because they mostly paid in the maximum during their employed lives. With a means test eliminating 2 million (7%) of the present recipients on the average, I would save 10% of the present outlay, $52 billion.

Approximately 15 million out of 130 million Federal tax returns in 2002 (SATUS 2006 Table 474) reported an adjusted gross income above the cutoff limit for social security taxes ($84,900 in 2002). At present, only wages and salaries are taxed, and only up to the cut-off limit. First of all, I would abolish the cutoff limit, and I would tax all classes of income except for tax-exempt municipal bond interest. These changes would easily increase the total social security tax collection (approximately $490 billion in 2005 (SATUS Table 536, value for 2005 estimated from last year given, 2004) ) by 10%, or $49 billion.

There are 139 million people in the US who were employed in 2004, say 140 million in 2005 (SATUS 2006, Table 576) Of these 21 million were employed by federal, state, and local governments (SATUS 2006, Table 451) These pay no social security tax, on the grounds that “they have other pensions”. However, virtually all of them will work for five quarters in a social-security-taxed job after retirement from government service, and thereby qualify for the minimum social security benefit in addition to their public-sector pensions. This practice is as old as the social security system itself, and goes by the very descriptive term of “double-dipping”.

I would bring these workers into the social security system, raising the tax income to the system by 15%, or $73.5 billion.

All together, these changes in the social security system increase its income by $122.5 billion, and reduce its outgo by $52 billion. Although together they achieve a major fraction of the goal of deficit reduction at present , they merely postpone the ultimate problem into the future; those 21 million government workers will eventually retire with full social security pensions.. To save the system completely we will need “private accounts”. However, these will be financed not with a diversion of present taxes (7.5%), but with an additional 2.5% levy. Funds generated from this assessment will go into a personally-owned account in the earner’s name, which will be invested in an age-appropriate mutual fund, managed by expert financial professionals. The stock portion of this fund will be invested in a portfolio of index equity funds, while the bond portion will be invested in a portfolio of Treasury Bonds, of laddered maturities.

Medicare I would treat the same way, with a means test eliminating the wealthiest 7% of the present recipients. This will probably only save 5% of the outlays, because this fraction has been able to afford better medical care all along, and is probably healthier than average. However, that is still $11 billion. I would, however, require that these persons only pay Medicare’s price for any services they receive which would otherwise be covered by Medicare. That this is a non-trivial benefit is illustrated by an example I recently experienced. I recently had a pelvic and abdominal CAT scan for which the billed charges were $3029; Medicare paid $437.

When I deal later with the entire medical-care industry, I will be able to make further savings here (See Chapter 7). I would act immediately, however, to end a major abuse of society’s willingness to help those in need. This is the dodge to offload onto Medicaid the job of taking care of the elders, used by families who can perfectly well afford to do it themselves (either with paid help at home or in nursing homes). The old folks give away their houses and other assets to the kids, call themselves paupers, and check into a nursing home with the taxpayer picking up the tab. I will extend the means test for Medicaid paying nursing home bills to include the assets of the offspring as well as the old folks. I mean, give us break!. Parents are expected to support the kids when they are young and not economically self-sufficient. In my system of values, the kids should reciprocate and support the old folks if necessary in their declining years. To beggar the oldsters and dump them in a nursing home paid for by the taxpayers is an abdication of that responsibility. I would deny Medicaid support to families who really don’t need it because the kids can help out. This change will not really save all that much money now, maybe a billion or so. However, it will nip in the bud a growing trend, and head off much bigger costs later on. If the few who are doing this now get away with it, millions will do it in the future; they would be suckers not to.

The interest on the national debt might seem quite inflexible, and not amenable to reduction at all. However, the contrary is true.; taking the federal government impact on the capital markets of the world from a $450 billion withdrawal to $160 billion deposit, plus the injection of billions of dollars of Treasury bond purchases by social security private accounts should permit long-term interest rates to drop. A ten percent decrease would reduce interest payments by $18 billion.

I will lop all federal subsidies out of the $69 billion transportation budget. Every system of transportation has to pay for itself. Automotive transport (roads, bridges, traffic control) must be paid for entirely by taxes on fuel, and possibly on the vehicles themselves. Air traffic facilities and control have to be paid for by surcharges on tickets. If these subsidies are eliminated, rail traffic may become more competitive, and not require subsidies to exist. I think an easy $7-10 billion can be achieved here.

Another area where I will get savings will result from the elimination of the cash transaction system, and putting the whole economy on an electronic debit card basis. As I will explain more fully in Chapter 9, this will make it a lead pipe cinch to garnish wages or other receipts, regardless of where the individual is. I will use this to force runaway fathers to pay for supporting their children, thereby eliminating the need for a substantial fraction of the aid to dependent children.

I won’t quantify the savings here until the reform it depends on is in place., but I would guess that I ought to be able to save $10B without reducing the income of a single poor person (except the irresponsible fathers)..

Another area of government that is also a prime candidate for financial amputation is the Department of Agriculture. It spends around $26 billion a year in price supports, raising the price of food, while Health and Human Services spends another $53B to subsidizing the poor so they can afford to buy the food at the artificially inflated price. (SATUS 2006, Table 463)

This is a somewhat difficult area, because there is a real problem for farmers in the economics of farming. As the agricultural market is presently structured, the farmer bears all the risk and shares in very little of the profit. The agricultural subsidy system is a Depression-era invention designed originally to push some of the risk onto the taxpayers.

Look at it this way. The farmer must estimate how much crop he can sell nearly a year before he sells it, and he is flying blind as to reliable information about what the price will be. He has better odds at Las Vegas. He has to borrow money, usually from the Farm Home Loan bank (insured by the taxpayer), mortgaging the only asset he has, his farm, to finance the planting and harvesting. The total income he gets from the crop depends on two things: how good his crop is, and how high the price is.

If he has a great crop, chances are all the other farmers growing the same crop had a great crop too, and the price drops to absurd levels, and he doesn’t make enough to pay off the loan. Two or three years of great crops, and he is bankrupt. If it was a terrible year, due to drought or hail or other calamities, he has a lousy crop. Probably everybody else had a lousy crop too, so the price is high, but he hasn’t got enough crop to sell. He still doesn’t make enough money to pay off the loan. At both extremes, the farmer loses his shirt.

The only time the farmer makes a profit is when everybody has a sort of mediocre year, so that the price doesn’t collapse, but he still has a reasonable amount of crop to sell. This might happen one year in three. The agricultural subsidy system was originally designed to put a floor under the price by having the government buy surplus in good years, and selling it back in poor years when the price was high. You would think this would be a profit center for the government because it would always buy low and sell high. However, for political reasons, the floor price has always been set too high, so that the big farm combines found it profitable to get into the business of producing enormous surpluses solely to sell to the government. In very few instances has the government ever been able to sell high. It usually gives the surpluses away: cheese, anyone?

In the meantime, the processing of farm crops has increasingly been taken over by giant agribusinesses: Archer-Daniels Midland, General Mills, Kellogg, Ralston-Purina, Conagra, and their ilk. These people make money in good years and bad. I know; I have been an investor in this business area, and I have read their annual reports. When crops are poor and the price high, they tack on not just the crop price increase itself, but the increase plus their “traditional mark-up” on that increase, even if none of their other costs have increased at all. Their profit increases in poor crop years. When crop prices go down in good years, they drop the price of their food products to the customer by the amount of the crop-price decrease, but leave the previously-added mark-up in place. They bear none of the risk inherent in the agricultural gambling with nature, and they make far more profit than the farmers. So the farmer has only the taxpayer to turn to.

It would be unfair and unsound to get the taxpayer out of shouldering the farm-risk by dumping it back on the farmer. As Dictator, I would make the agribusiness giants shoulder a big share of the farm risk; after all, they get the lion’s share of the profits.

Here’s how it would work.

Prior to the start of the crop year, the agribusiness food processors would be required to estimate their total demand for each major food crop for the coming year, and to contract in advance to buy 80% of that requirement. These contracts would be sized in amounts convenient to a majority of the farmers, and would be sold by silent auction, through farm cooperatives in the growing states. Farmer A, who knew what his costs were, could estimate how much he could grow at what cost, and bid on enough contracts at a price to make a profit. If Farmer B had lower costs, his bid could be lower in price, and he would be more likely to sell all he could grow than Farmer A. Of course, both of these are in competition with all other farmers across the Nation in bidding for these contracts, but each one would know about how much he could sell before seed one was planted. For its part, the agribusiness would buy some crops at very low prices from the most efficient lowest-cost farmers; it wouldn’t be able to satisfy all its requirements in that way, and would have to buy other crop at higher and higher prices. In practice, therefore, crop contracts would be bought over a wide spectrum of prices to make up the eighty-percent of total requirements. Hopelessly inefficient farmers would be unable to bid low enough to capture any contracts, and would have to grow other less-competitive crops or get out of the business entirely.

The agribusiness would have to make a down payment of 75% of the purchase price at the time of writing the contract, the balance to be paid on delivery. Thus the farmer has his financing in hand at planting time, and doesn’t have to mortgage the farm to get a crop in.

Of course, the smart farmer, knowing that only eighty percent of the market has been bid for, will plant a little extra to try to cash in on the spot sales needed to make up the difference. Suppose it is a great crop year, and the harvest is bountiful. The spot price drops, because there is a surplus of crop planted on speculation. But the farmer still collects the balance of the contract price for the contract crop. He will probably not be able to sell all of his extra crop, and that which he sells will be at a rockbottom price. However, this was incremental production, and anything he gets for it is gravy. The only role of the government in this market will be to store the unsold speculation crop for him at reasonable cost (but not at a loss!).

However, the farmer still makes the profit he figured when he bid on the contract crop, even though there was a great crop surplus, and he gets some of the incremental gravy. Unlike the result in the present system in the absence of price supports, a great crop year is a benefit to the farmer instead of a financial disaster.

If it is a poor crop year, and the farmer does not get enough yield to meet his crop contract commitment, he either withdraws from storage some of his surplus crop from a previous year, or buys the shortfall at the spot price to add to his yield enough to meet the contract commitment. This is not the ideal situation, but if he has figured reasonably conservatively, he probably won’t be destroyed by a bad crop year.

This system will tend to be fairly self-correcting. After a great crop year, when every farmer will have in storage unsold surplus speculation crop from the previous year, the contract bids will all be lower as farmers bid first to move the surplus to market, perhaps even to the extent that some farmers sell only surplus from storage, and don’t plant a crop at all. Not necessarily the ideal for them, but- and it’s a great big but- they will know before touching a plow to the south forty whether they should plant or simply let the field lie fallow for a year. They will know the major fraction of their own market situation before planting time, not at harvest time. At least they won’t bet the farm on a mortgage to plant a crop they can’t sell.

The risk to the agribusinesses will come in deciding whether to bid out more than eighty percent of their requirements, to protect themselves against shortages and high spot prices in the event of a bad year. The risk is, of course, that in a great year they could buy the balance of their requirements at a low spot price. They are in a lot better position with their market intelligence to estimate these risks than the individual farmers are. The agribusinesses also bear the financing cost of the 75% down payment. Again, they are in a much sounder financial position to do this than the farmer; they don’t have to bet the farm to get the financing.

Since a major fraction of the market risk and all of the financing costs have been offloaded from the farmer to the agribusinesses where they belong, there will be no need for the government to set floor prices and buy surpluses to assume some of that risk. Consequently, the Department of Agriculture budget can go down by $26 billion a year: not a vast sum in the present situation, but as Tip O’Neill once said “A billion here, and a billion there, and first thing you know, it adds up to real money.”

So, let’s do a little addition: More effective tax collection, $170 billion; Social Security, $52 billion saved by a means test; Medicare, $11 billion by the same means test, plus $1 billion from elimination of beggaring the old-folks so that Medicaid pays for their nursing-home costs; Interest, $18 billion by reduction in the interest rates; Transportation, $7 billion from elimination of subsidies; Garnishment of absent-father wages for child support, $10 billion; Agriculture, an average of $26B. Total, $297 billion savings, without any real damage to the poor, or to oldsters for whom social security is the only lifeline. On the plus side income of the social security system is increased by $122.5 billion. The total net swing from these changes in reducing the deficit is $419.5 billion, eg almost wiping it out.

The balance, I am going to get by introducing efficiencies in operation of all government departments. First of all, I will abolish all public sector unions. Public sector employees are protected under civil service laws and do not need unions to bargain for their wages and working conditions. These employees may form associations to lobby for their own particular points of view, but they will not have any say in the wage structure or working conditions, such as staffing of the various bureaus and agencies.

Second, I will change the way budget overages and shortages are managed. At present, no agency or department head wants to see his organization spend less than the budgeted amount. It is considered a colossal mistake to return any unspent funds to the Treasury; hence in any bureau with an unspent balance, at year-end there is an orgy of purchasing all possible supplies that might remotely be needed in the future. Moreover, there is a huge bias toward overstaffing. A Civil Service manager’s pay grade and salary are determined by how many people report to him. Therefore, he does not look to see how efficiently the job can be done and with how few people, but how inefficiently it can be done, and how many more direct reports he can claim to need. Finally, there is no independent feedback process to determine how well the organization does its job.

I will change all of these factors. First, each agency will have to identify those who are the customers for its service. Those customers will at fiscal year end be surveyed to rate the agencies’ performance as Outstanding, Acceptable, or Not Acceptable (Guess where FEMA would land on this scale). If an agency’s performance is outstanding, 75% of any budgeted funds remaining would be distributed among the employees, to each in proportion to salary. If performance is acceptable, only 37.5% of surplus would be distributed as bonus. If performance is not acceptable, the staff would all take a 10% cut in pay.

Since salaries constitute a significant fraction of an agency’s budget, there will be an impetus for the manager to minimize staffing: to reduce total salary costs, and to stimulate his subordinates to work particularly hard, in order to achieve the coveted outstanding rating at minimum cost. Since every member of the organization shares in the resulting bonus, they will have the incentive to deliver maximum performance as well. To remove the civil service bias toward overstaffing, I will make every manager’s pay grade depend on the achievement rating from customers rather than the number of direct reports.

With this change in the way the government operates, I will save enough more money to complete the job of balancing the budget, $10.5 billion. I will also reduce government employee head count, and perform all the government functions better

Having reduced the costs of government to bring them closer into balance with current income, I would then have a moral basis for telling the citizenry. “Read my lips! your taxes are going up to finish the job. But a good fraction of the increase will be earmarked for one and only one purpose, to reduce the National Debt.” Having seen that a hose clamp has been put on the umbilical cord of the government, the citizenry will not grumble too much, I think, about being asked to do its share in correcting the excesses of the last five years.

As a temporary expedient, because I don’t want to fight battles on too many fronts at once, I wouldn’t tackle at this time the abomination known as the Federal Income Tax. Reform won’t save it; nothing less than abolition and starting over will do. However, I would postpone action on this subject until later in my Dictatorship (and later in this book) until I got a few other things straightened out first. So for now, I will simply levy a surtax on every tax the Federal Government collects,

Now that I have rammed through an American Perestroika to get the economy back on course to generate the wealth that makes the country great, and to produce the funds with which to solve social problems, I will turn my attention to some of those problems.

September 20th, 2009 at 8:46 pm

Chapter 1

* Summary: “befor”

* equilateral right triangle (two sides equal?)

* Federal expenditures table, put in pareto form, include “all other” category at end

* not sure I understand the line about $240B vs $180B. Do we need to cut by $240B or $180B?

* Discussion of Social Security, Medicare, etc. Give a subsection headings “Social Security”, “Medicate”, etc.

* 2nd to last para: “enough more”

* Add link to next Chapter

July 14th, 2020 at 9:04 am

QCfHJOMd

December 24th, 2020 at 11:53 am

Lolita Bird Loli Teen Fucked Whip-round

Pthc cp daughter porno

xtl.jp/?My

January 16th, 2021 at 3:57 pm

from lat. manus – “hand” and scribo – “I write”) ]

January 28th, 2021 at 12:03 pm

At the same time, many antique

February 20th, 2021 at 6:00 pm

drafts of literary works

March 14th, 2021 at 3:32 am

Century to a kind of destruction:

April 16th, 2021 at 12:24 am

“Julia’s Garland” (fr. Guirlande de Julie)

June 20th, 2021 at 1:24 pm

Europe, and in Ancient Russia

July 14th, 2021 at 12:54 pm

Жилье должно быть комфортным. Именно поÑтому ÑтроительÑтво нужно доверить профеÑÑионалам. ÐšÐ°Ð¶Ð´Ð°Ñ ÑÑ‚Ñ€Ð¾Ð¸Ñ‚ÐµÐ»ÑŒÐ½Ð°Ñ ÑпециальноÑÑ‚ÑŒ по Ñвоему интереÑна, и может принеÑти неплохой результат, еÑли к ней подойти правильно

July 31st, 2021 at 8:52 am

from lat. manus – “hand” and scribo – “I write”) ]

August 12th, 2021 at 3:23 am

among them acquired “Moral

August 12th, 2021 at 12:46 pm

among them acquired “Moral

August 17th, 2021 at 10:30 am

55 thousand Greek, 30 thousand Armenian

August 19th, 2021 at 5:04 pm

from lat. manus – “hand” and scribo – “I write”) ]

August 22nd, 2021 at 5:57 am

Western Europe also formed

January 4th, 2022 at 7:34 am

consists of the book itself

April 27th, 2023 at 8:31 am

Good response in return of this query with real arguments and telling everything regarding that.